Income planning for retirement can be a daunting task for many retirees because there is a lot to learn, and to many people, a lot of the information is new. Whether you are just setting out on your retirement journey or it is already well underway, you may be skeptical of whether you’ll have enough retirement income to maintain a comfortable and enjoyable lifestyle.

The accumulation phase

The distribution phase

The preservation or transfer phase

Planning for your retirement may require a shift in mindset and a solid understanding of the difference between retirement savings and retirement income. Prior to retirement, your financial life was dictated by your paycheck.

However, once you retire, you can no longer rely on a paycheck, which means you will be left to find other sources of income. You’ve worked hard to save for retirement, and now the time has come to find methods of creating income from what you’ve saved.

Although this can represent a challenge for many, it also represents a great opportunity to help grow your savings beyond what you’ve saved — and this is usually made easier by enlisting the help of financial services professional that you trust.

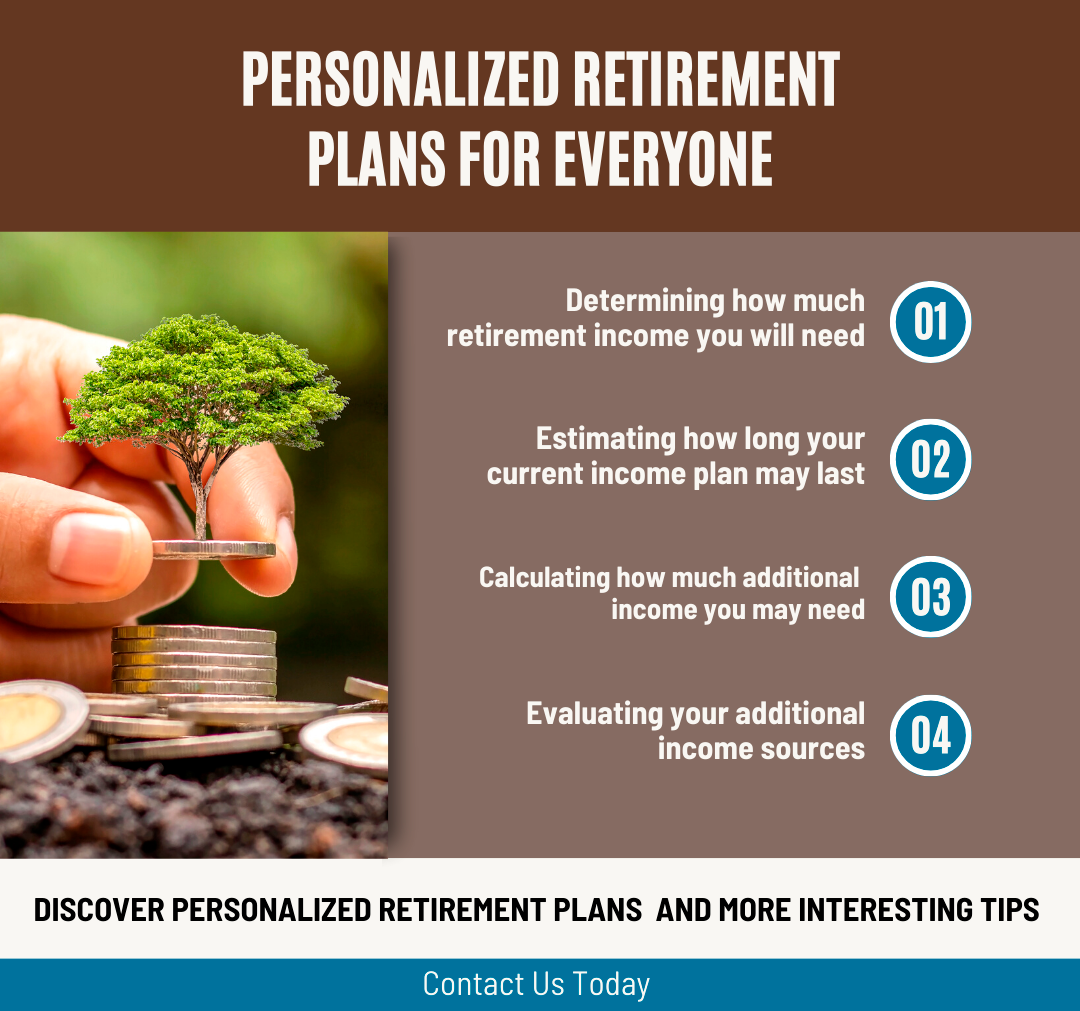

FSS Group will work with you to help you uncover the various opportunities and concerns of each phase. Additionally, we will walk you through the process of-

Because taxes play a significant role in any financial planning process, our firm will utilize tax-advantaged vehicles to accommodate your retirement income goals, such as traditional IRAs, Roth IRAs, 401(k)s, and IRA rollovers.

Keep in mind while the numerous options for your retirement savings may seem overwhelming, all of us at FSS Group are here to help you make sense of it all.

Retirement planning is an integral step in securing your financial future. However,iIt can be daunting if you don’t know where to start. But it doesn’t have to be; With the proper knowledge and resources, you can easily craft a retirement plan to ensure your security and peace of mind for years to come.

The sooner you begin retirement planning, the better off you'll be. Even if your retirement seems far away, it's never too early to start preparing for it.

Time is one of the most important factors in crafting a successful retirement plan because with time comes compound interest, a powerful tool that allows your savings to grow without additional effort. The earlier you begin investing, the greater your returns when it comes time to retire.

Before setting up a retirement plan, you must determine what goals you want to achieve with that plan. Consider what kind of lifestyle you want during your retirement years and how much money will be needed.

Once those goals are established, take into account other sources of income, such as Social Security or inheritance, so that you have an accurate picture of how much money needs to be saved.

Once you know your goals and how much money needs to be saved to reach them, set up a retirement account with a fine financial institution. These institutions offer several different accounts, such as 401(k)s or IRAs (Individual Retirement Accounts).

Nevertheless, it's essential to research these accounts beforehand to understand their differences and choose the one that best meets your needs. Additionally, make sure all contributions are tax-deductible, so they don't impact your bottom line come tax season!

If you need a financial expert’s assistance to help establish your retirement plan, FSS Group is always here for you. We will help you make the best decisions to prepare for a financially secure retirement.

Retirement planning doesn't have to be a stressful process! With our Personalized Retirement Plans, you'll have an experienced professional guiding your every move toward achieving retirement success.

From sophisticated strategies for investing in stocks and bonds to helping you keep more of what you've saved before retirement, our personalized retirement plans ensure that your golden years will be just as bright and sunny as the ones before them!

Don't get caught off guard by unexpected twists and turns; with our guidance, you can find the best path toward the retirement plan that works for you. Let us help you create your personalized retirement plan!

Honesty & Transparency: Our firm strives to create a secure financial future for all our clients. With thoughtful money management and open conversation about their goals and plans, individuals can have confidence in the road ahead.

Innovative Investment Strategies: We create uniquely customized portfolios tailored to the individual needs of our clients. Working diligently, we leverage market insights and data-driven analyses to ensure that investments remain both secure and dynamic.

Exceptional Customer Service: At FSS Group, we prioritize ensuring that every customer is given an outstanding experience. We put their needs first as they journey with us toward success.

FSS Group is just a phone call away from you if you are interested in using our expertise and services for your retirement plan.